Below we explain them section by section. The three forms differ in some ways, but the fundamental basics are the same.

Elster online identifikationsnummer registration#

Gewerbetreibende (sole traders who operate commercially) will get the tax registration form via post after registering with the Gewerbeamt (Trade Licensing Office).įreiberufler (freelancers who have a ‘liberal’ profession) who don’t have to register with the Gewerbeamt, should submit this questionnaire to the local Finanzamt (tax office) as soon as possible. You can find a form for each business type at the Bundesfinanzministerium (Federal Ministry of Finance) website.

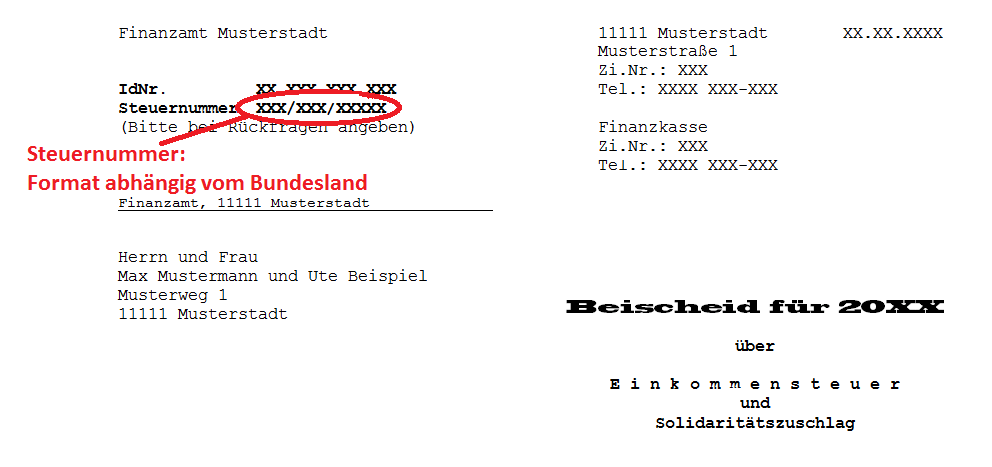

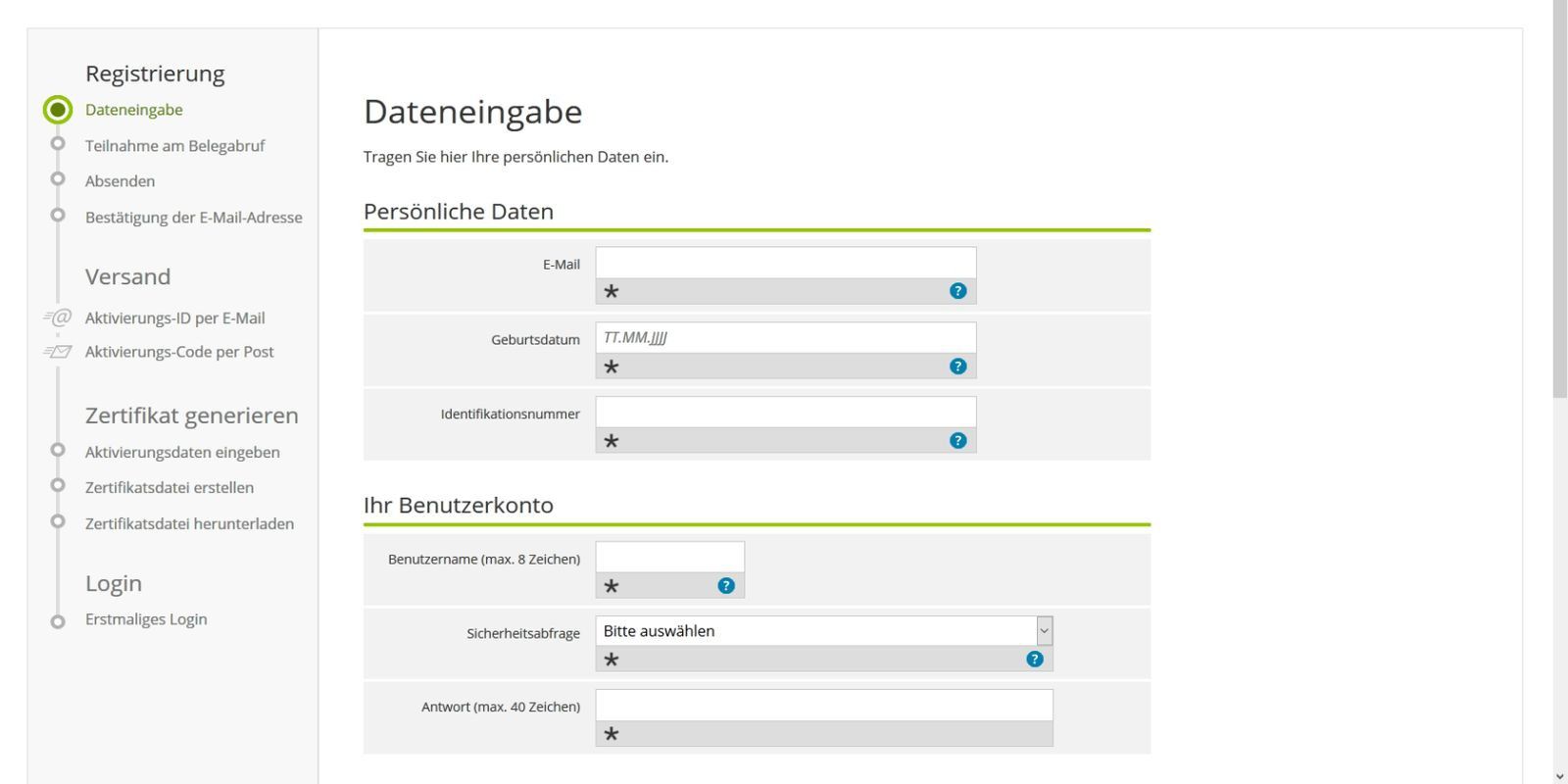

There is one form for Personengesellschaften (partnerships), one for Einzelunternehmen (sole proprietorships) and one for Kapitalgesellschaften (incorporated companies). The information requested in the tax registration form depends on the legal structure of your business. What data does the tax registration questionnaire require? This is an essential step because only with this tax number can a business issue invoices. The Fragebogen zur steuerlichen Erfassung (also known as the Betriebseröffnungsbogen, or business opening questionnaire) collects tax-related data of a business/entrepreneur to help the authorities identify which taxes apply.īy completing this form, a business (company, self-employed person etc.) registers with the Finanzamt (tax office) and receives a Steuernummer (tax number). Why do I have to fill in the Fragebogen zur steuerlichen Erfassung (tax registration questionnaire)? What other info can help you on your way? Read on to find out everything you need to know about the tax registration questionnaire. Ideally you should do this after registering with the Gewerbeamt (Trade Licensing Office). Together with the tax return, an electronic balance sheet (e-balance sheet) must be sent to the tax office.To register a business for tax purposes, you have to accurately fill in the Fragebogen zur steuerlichen Erfassung (tax registration questionnaire). Once determined by the tax office, advance payments of corporation tax may be made on a quarterly basis.Ĭorporations are, in principle, required to keep accounts.

The declarations must be submitted digitally to the tax office. If the returns are drawn up by a tax adviser, the tax return period will expire only at the end of February of the second following year. The corporate and business tax return must be submitted annually, by 31 July of the following year. Overall, the average corporate tax burden is around 30%. In addition, a trade tax is levied by the municipalities on corporations that maintain a domestic permanent establishment. The amount of the tax is also subject to a solidarity surcharge of 5.5%. Capital gains may be exempt from tax under certain circumstances.Ĭorporate profits in Germany are subject to corporation tax at the rate of 15%. This concerns, for example, profits from domestic branches and permanent establishments.Īll corporate profits, capital gains and capital gains, among other things, are taxable. Corporations are, in particular, limited liability companies, such as a Gesellschaft mit beschränkter Haftung (GmbH).Ĭorporations that have no registered office or management in Germany may be liable to tax in Germany if they receive domestic income. Corporations which have their registered office or management in Germany are in principle subject to tax on their global income.

0 kommentar(er)

0 kommentar(er)